ArcelorMittal no longer expects hydrogen-based ironmaking or carbon capture and storage (CCS) to become economically viable before 2030. In its 2024 sustainability report, the company concludes that these technologies remain too costly and that the necessary infrastructure is not yet available.

– Green hydrogen is not yet a realistic fuel, natural gas-based direct reduced iron (DRI) production is not competitive in Europe, and CCS remains at the planning stage, the company writes.

Even in markets with carbon pricing, gas-based DRI struggles to compete with coal-fired blast furnaces. Green hydrogen is even further from profitability. Over the next five years, ArcelorMittal plans to focus on reducing emissions by increasing the use of recycled scrap in electric arc furnaces. Meanwhile, the company's carbon-intensive blast furnaces are expected to remain in operation for the coming decade.

– Both green hydrogen and CCS increasingly appear to be solutions for the post-2030 period, ArcelorMittal states, although it intends to continue developing these technologies for future use.

High costs hinder the green transition in steel

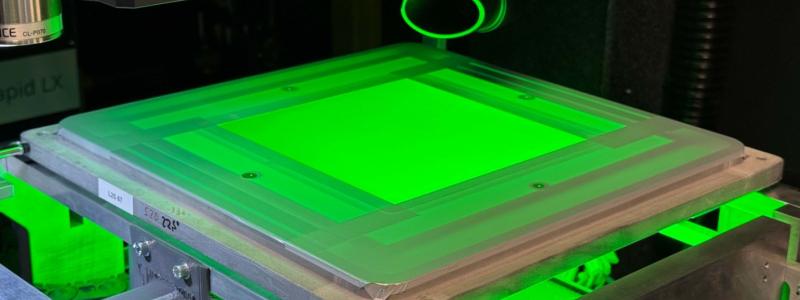

The steel industry accounts for between seven and eight per cent of global carbon dioxide emissions. Transitioning to low-carbon production requires new technologies, with green hydrogen replacing fossil fuels in DRI plants. This process produces water vapour instead of carbon dioxide. The resulting iron can then be melted in electric arc furnaces powered by renewable electricity – currently the only proven method for fossil-free steel production.

However, in Europe, green hydrogen costs more than five euros per kilogram, leading to very expensive steel that requires customers willing to pay premium prices. ArcelorMittal announced in November that it was postponing final investment decisions for several hydrogen-ready DRI plants in France, Belgium, Germany, and Spain – projects initially scheduled to come online this year or next.

Green hydrogen and CCS are not viable before 2030

Despite receiving billions in public funding, including 900 million Canadian dollars for a DRI facility in Hamilton, Canada, ArcelorMittal does not expect production to begin before 2028. According to the company, current support for the green transition is insufficient.

– Steel is a low-margin industry marked by global overcapacity. Without a global carbon price, there is a clear risk that early movers will lose competitiveness, ArcelorMittal writes.

Political uncertainty slows climate efforts

ArcelorMittal emphasises that current incentives are inadequate to make green steel a sustainable business model. The company points to recent European Union industrial policy initiatives, including the Clean Industrial Deal and the action plan for steel and metals. Nevertheless, these measures are still deemed insufficient to meet the realities of the transition.

The climate targets ArcelorMittal set in 2021 now appear increasingly difficult to achieve. At that time, the company pledged to reduce emissions intensity by 25 per cent globally and 35 per cent in Europe by 2030. Although absolute emissions (Scope 1 and 2) have fallen by 46 per cent since 2018, emissions intensity has only decreased by 5.4 per cent – adjusted for sold or closed facilities.

– We will publish updated climate expectations once the political landscape becomes more stable, the company states.

Currently, ArcelorMittal operates 32 blast furnaces, 43 converters, 28 electric arc furnaces, and 11 DRI or HBI plants. At the same time, new steel grades are being developed for the energy sector, designed to withstand embrittlement in future hydrogen pipelines.